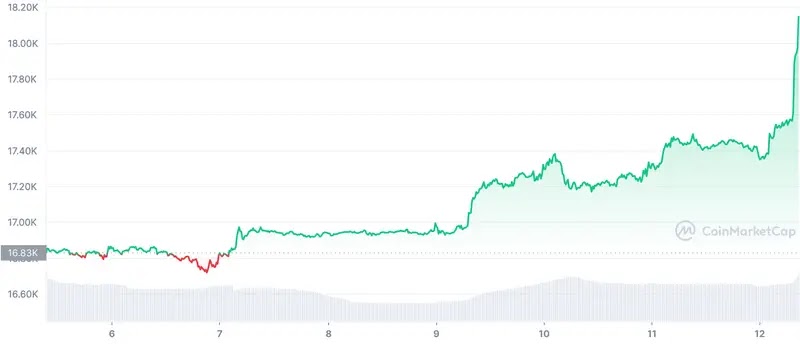

Bitcoin's $18K Surge Breaking Above a Major Bearish Trend Line

One of the key factors that has driven Bitcoin's recent rise has been the break above a major bearish trend line with resistance near $17,000 on the hourly chart of the BTC/USD pair. This move has also been accompanied by an increase in trading volume, indicating that there is strong buying pressure behind the recent rise in the cryptocurrency's price.

The break above this trend line is a bullish sign for the market, as it suggests that the bears have lost control and that the bulls are now in control. This trendline has been in place for a few months and has been a key level of resistance that Bitcoin has been unable to break above. The recent move above this level is a positive sign for the bulls and suggests that the cryptocurrency may continue to climb higher in the near term.

Stable Support at $16,800

Furthermore, Bitcoin has been able to hold on to its support near the $16,800 zone after a slight correction, which has allowed the cryptocurrency to continue its uptrend. This support level has been a key level for the market, and its ability to hold during a correction is a positive sign for the bulls.

Additionally, the cryptocurrency's price has now settled above the 100 hourly simple moving average, which is a positive sign for the bulls. The 100 hourly simple moving average is a key level of support and resistance for the market, and its ability to hold above this level suggests that the bulls are in control.

Key Resistance Levels to Watch

As Bitcoin continues to climb higher, experts are keeping a close eye on key resistance levels such as $17,450 and $18,000. Should the cryptocurrency be able to break through these levels, there is a possibility that we could see another steady increase in its price, potentially towards the $18,500 zone in the near term.

The $18,000 level has been a key level of resistance for the market, and its ability to hold as resistance in the past suggests that it may be a key level to watch in the future. If Bitcoin is able to break above this level, it could suggest that the bulls are in control and that the market is ready for another strong rally.

On the other hand, the $17,450 level is a key level of resistance, and its ability to hold as resistance in the past suggests that it may be a key level to watch in the future. This level has been able to hold as resistance for a significant amount of time, and its ability to hold as resistance again in the future could suggest that the market is not yet ready for another rally.

Short-term Dips to Watch Out For

However, it is important to note that while the current trend is bullish, there is still a possibility that the cryptocurrency could face some short-term dips. For example, if Bitcoin fails to break above the $17,350 resistance, it could lead to more downside pressure. In this case, key support levels to watch include $17,150 and $17,000.

These levels have been key levels of support in the past, and their ability to hold as support in the future could suggest that the market is not yet ready for another bearish move

Technical Indicators

Looking at the technical indicators, it's clear that the market is currently in bullish territory. The hourly Moving Average Convergence Divergence (MACD) is currently in the bullish zone, which suggests that the bulls are in control. Additionally, the Relative Strength Index (RSI) for BTC/USD is currently in the overbought zone, which suggests that the market is currently overbought and that a short-term pullback may be imminent.

It's worth noting that technical indicators should not be used as the sole indicator of market sentiment and should be used in conjunction with other forms of analysis.

Institutional Adoption and Weak US Dollar

Another factor that has been driving the recent price increase is the increasing institutional adoption of Bitcoin. As more institutional investors enter the space, they bring more buying pressure to the market, which in turn drives the price higher. Additionally, the weaker US dollar has also been a factor, as investors may be turning to Bitcoin as a hedge against inflation.

Conclusion

Bitcoin's recent move above $17,000 is a positive sign for the bulls and suggests that the cryptocurrency may continue to climb higher in the near term. However, investors should still approach the market with caution and do their own research before making any investments. The market is still volatile and a short-term dip may be imminent. Key resistance levels to watch include $17,450 and $18,000, while key support levels to watch include $17,150 and $17,000.

It's important to remember that the future of Bitcoin's price is uncertain and that past performance is not an indicator of future results. It's crucial to keep an eye on the market conditions, to be aware of any possible shifts and make informed decisions.

0 Comments